Consequently, the cost of a unit of product in inventory or the cost of goods sold under the variable costing method does not contain any fixed manufacturing overhead cost. The only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead. Using absorption costing, fixed manufacturing overhead is reported as a product cost. Using variable costing, fixed manufacturing overhead is reported as a period cost. Figure 6.8 summarizes the similarities and differences between absorption costing and variable costing.

Deciding Between Variable and Absorption Costing

As a result, effective management of variable costs can lead to improved profitability and long-term success. Embracing variable costing arms businesses with the visibility required to make decisions that drive profitability. While more complex than absorption costing, the precision and insight variable costing offers makes it an invaluable tool for financial management.

- It can result in higher inventory values and profits when production exceeds sales.

- Absorption costing is a costing method that allocates both variable costs and fixed manufacturing overhead costs to each unit produced.

- As such, absorption costing ensures proper inventory accounting and adheres to external reporting standards.

- Analyzing internal production costs vs. outsourcing supports informed sourcing choices to maximize profitability.

- Understanding variable costs is crucial for businesses to efficiently allocate resources and maximize profitability.

Variable Costing in Break-even Analysis

Variable costing provides a better view of marginal profitability, while absorption costing adheres more closely to GAAP and matches all production costs against revenue. Variable costs stand in contrast with fixed costs, since fixed costs do not change directly based on production volume. Between variable and fixed costs are semi-variable costs (also known as semi-fixed or mixed costs). Factors like production volume, cost per unit, and economies is owing the irs money a bad thing not necessarily of scale influence variable costs, impacting profitability. Since fixed costs are more challenging to bring down (for example, reducing rent may entail the company moving to a cheaper location), most businesses seek to reduce their variable costs. Examples of variable costs include a manufacturing company’s costs of raw materials and packaging—or a retail company’s credit card transaction fees or shipping expenses, which rise or fall with sales.

Semi-Variable and Mixed Costs

This calculation gives insight into the efficiency of the production process by assessing the variable cost per unit produced. A lower average variable cost indicates that the production process is more cost-efficient. These are just a few examples of variable costs that businesses must manage as they strive to deliver their products or services efficiently and cost-effectively. Absorption costing values inventory higher as it includes allocated fixed production overheads. Variable costing income statements enables management to see and understand the effect that period costs have on profits and facilitates better decision-making.

Why Is the Accrual Basis of Accounting Accepted by GAAP?

Regularly monitoring and adjusting to these shifts is crucial for maintaining profitability. Fixed costs are expenses that remain the same regardless of production output. Whether a firm makes sales or not, it must pay its fixed costs, as these costs are independent of output. Because variable costs directly correlate with production and sales, they are essential for precise cost projections. This formula helps businesses determine the expenses directly related to the production or sales volume of their products or services.

What Is the Difference Between Operating Margin and Gross Manufacturing Margin?

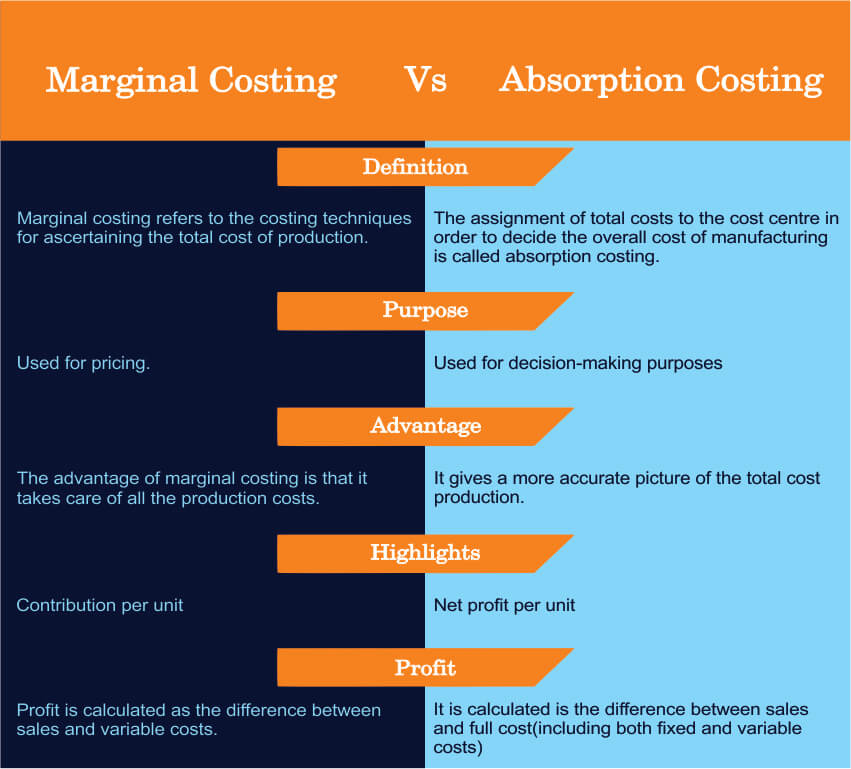

The key difference from variable costing is that fixed manufacturing overhead costs are treated as product costs under absorption costing. Variable costing is a managerial accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in unit product costs. Fixed manufacturing overhead costs are treated as period costs and are deducted in full as an expense in the period incurred. The key difference between variable and absorption costing lies in the treatment of fixed manufacturing overhead costs. Under absorption costing, they are allocated to units produced as product costs.

The definitions of full costing and costing variables and their strengths and weaknesses are provided below, along with examples. Production is estimated to hold steady at \(5,000\) units per year, while sales estimates are projected to be \(5,000\) units in year \(1\); \(4,000\) units in year \(2\); and \(6,000\) in year \(3\). In summary, both methods have merits depending on business context and intended use. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

With variable costing, fixed manufacturing overhead costs are treated as period costs and therefore are always expensed in the period incurred. Because all other costs are treated the same regardless of the costing method used, profit is identical when the number of units produced and sold is the same. Under variable costing, fixed manufacturing overhead costs are treated as period expenses on the income statement rather than allocating them to units produced. This results in fixed costs being fully deducted in the period they are incurred, rather than shifting a portion of them into inventory. Consequently, net income is higher under variable costing when production outpaces sales, and lower when sales exceed production.