Rent payable liability is classified as short term or current liability in the balance sheet because it is highly expected to be met within one year period of the date of its creation. Rental expense will be present on the income statement and it will reduce the company profit during the month. Rent payable is the present obligation that company has toward the landlord. However, under ASC 842, the new lease accounting standard, prepaid rent is now included in the measurement of the ROU asset. Any prepaid rent outstanding as of the transition is included in the measurement of the ROU asset.

Accounting Treatment for Rent Payment

Any amount that is not yet paid to the landlord, needs to record as rent payable. When cash payments in a period were greater than the expense recognized, prepaid rent would money basics: managing a checking account be capitalized on the balance sheet with a debit balance. This was considered a prepayment, which is an asset, due to more rent being paid for than rent expense incurred.

Accounting for deferred rent with journal entries

This comparison of deferred rent treatment under ASC 840 and ASC 842 is illustrated in Deferred Rent Accounting and Tax Impact under ASC 842 and 840 Explained. Base on accounting principle, the company need to record revenue and expense base on the occurrence rather than cash paid. The payment on the rental contract may be different based on the arrangement between tenant and property owner. However, the company requires to record monthly rental expenses which are suitable for most of the business. It has to ensure that proper rental expenses are included in the annual financial statement.

- If all details of a contract are the same, organizations record the same amount for lease expense under ASC 842 as they would for rent expense under ASC 840.

- The concepts of Prepaid Rent are no longer recorded under ASC 842 as the payments are recorded as part of the ROU Asset.

- Straight-line monthly rent expense calculated from base rent is therefore $131,397 ($15,767,592 divided by 120 months).

- Because of the inclusion of the minimum threshold, the lessee has a commitment to pay at least the lower amount regardless of actual performance or usage.

Other considerations in the rent expense measurement

The journal entry accurately reflects the transaction that occurred and can help track the cash flow of a business. Under accrual system, the entry to recognize rent expense is passed on the basis of hold or usage of the property by the tenant entity. This treatment differs from cash basis of accounting under which no accrual entry is recorded and the rent expense is recognized only when the rental cash is paid to the land lord or the property owner. Rent payable incurs when the company records rental expense and does not yet make any payment to the property owner. The journal entry is debiting rental expense and credit rent payable.

Accrued rent vs deferred rent

Future payments for rent-related to operating leases were previously off-balance sheet transactions. This was beneficial to lessees in that the obligation for those payments did not drive up the liability balance. However, ASC 842 aims to increase transparency for stakeholders by including a lease liability and corresponding ROU asset on the balance sheet for operating leases. Under ASC 842, you would see the same entries, but the prepaid rent would be recorded to the ROU asset in place of a separate prepaid rent account. Additionally, at the time of transition to ASC 842, any outstanding prepaid rent amounts would be included in the calculation of the appropriate ROU asset.

The total liability balance (short-term and long-term liability balances) is often used by stakeholders to evaluate whether to invest or lend to an organization. Potential investors or lenders use those balances in financial ratios that often greatly contribute to decision-making. Organization’s lease activity is more transparent, which was ultimately the goal of the FASB’s issuance of a new lease accounting standard. The combined lease expense is now reported in the operating section of the income statement under ASC 842 in place of rent expense. Similar to fixed rents, the minimum rent is also included in the straight-line rent calculation for operating leases under ASC 840 and the calculation of the lease liability under ASC 842. When the actual rent amount is paid, any variance from the minimum threshold used in the initial valuation is recorded directly to rent or lease expense.

It is still only reported on the income statement and calculated on a straight-line basis. We trust this article helps you better understand how to prepare the journal entry for rent paid. If you have any questions, please use the comments section below, the “ask a question” section or our Contact Us page.

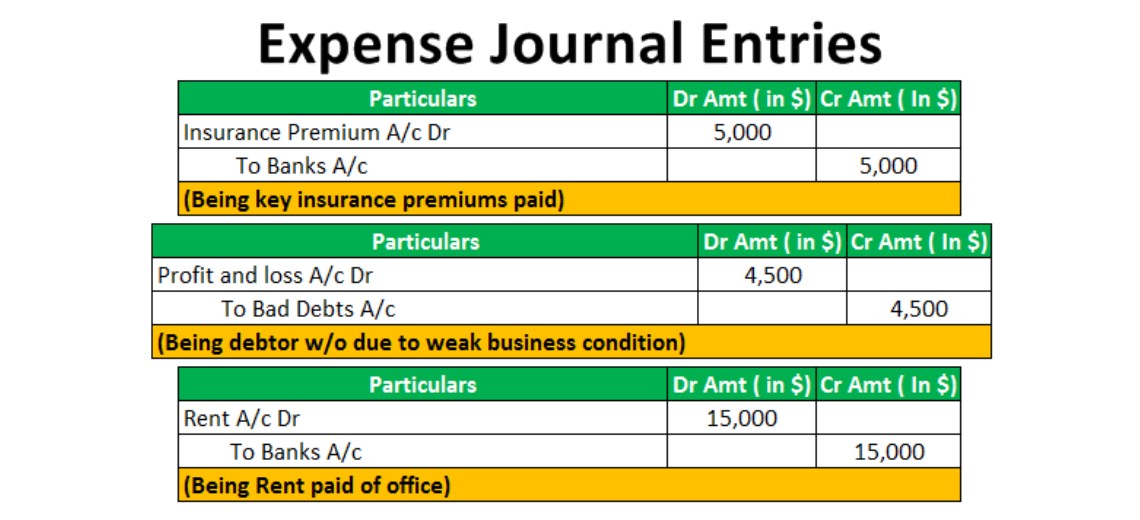

Lessees would simply record a debit to rent expense and a credit to cash, reflecting the expense for using the leased asset and the payment made within the same period. If a business does not own an office premise it may decide to hire a property and make periodical payments as rent. Such a cost is treated as an indirect expense and recorded in the books with a journal entry for rent paid. The party receiving the rent may book a journal entry for the rent received.